Michał Wrzosek Press Spokesman Budimex SA

michal.wrzosek@budimex.pl telephone: (+48) 22 623 61 12 mobile: (+48) 512 47 85 22

Michał Wrzosek Press Spokesman Budimex SA

michal.wrzosek@budimex.pl telephone: (+48) 22 623 61 12 mobile: (+48) 512 47 85 22

The Q1 2022 was a difficult period for: the Budimex Group, construction market and the whole world.

The outbreak of war in Ukraine has significantly affected most branches of our economy. The construction industry is one of the sectors hardest hit by the consequences of the conflict across our eastern border. The most important factors affecting our sector are a drastic increase in material prices, particularly of steel and oil, and outflow of workers from Ukraine.

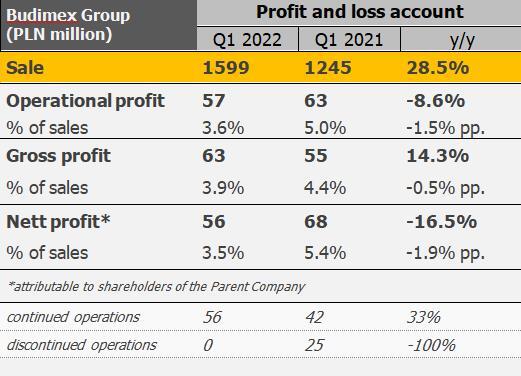

Despite extremely difficult market conditions, the Budimex Group generated an operational profit of PLN 57 million (compared to PLN 63 million in Q1 2021) while recording a decrease in profitability from 5.0% to 3.6%. Lower profitability results mainly from deterioration in the result in the construction segment. Majority of works carried out in Q1 2022 concerned contracts with some of the materials already on site and prices for key assortments and services for the following months having been contracted. Nevertheless, we observe that a drastic increase in material prices, including steel and oil, has affected profitability of most contracts, particularly those currently in the early stages of execution.

Gross profit of the Budimex Group amounted to PLN 63 million with profitability of 3.9% compared to 4.4% in the first quarter of the previous year. Profitability at the level of gross profit was supported by significant improvement in financial results, which resulted from an increase in the average level of interest on cash invested by the Budimex Group.

We recorded a significant increase in sales revenues of the Group, mainly due to a larger scale of sales realised in the construction segment. In the services segment, revenues were similar to the level of Q1 2021.

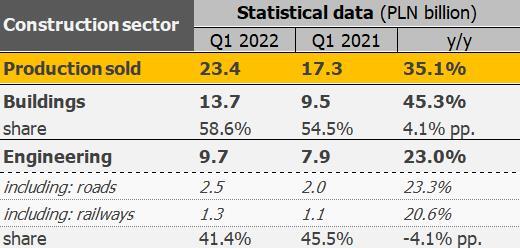

Construction and installation production in Q1 2022 (at current prices) increased year-on-year basis by 35.1% from PLN 17.3 billion to PLN 23.4 billion. In the buildings segment, production sold increased by 45.3%, while in the infrastructure segment the increase was as high as 23%.

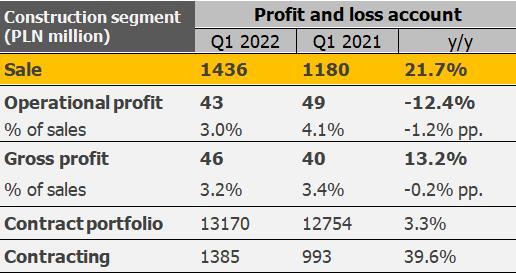

Sales of the Budimex Group's construction segment amounted to PLN 1,436 million in Q1 2022 (+21.7% y/y), while recording a decrease in both operating profitability (from 4.1% to 3.0%) and gross profitability (from 3.4% to 3.2%).

The scale of sales revenues in the construction segment, realised in Q1 2022, was significantly higher than in the corresponding period of the previous year. A high contract portfolio and favourable weather conditions allowed revenues to increase by more than 20%.

Gross profitability of the construction segment was 3.0%, down from 4.1% in the same period last year. We are experiencing a drastic increase in the price of materials, which can best be seen in the prices of different types of steel. We observe supply chain disruption in some areas, which further hinders contract execution. The budgets of all our projects are updated on an ongoing basis, while average profitability of the portfolio remains stable thanks to good profitability of the contracts in the final stages of execution. The impact of changing prices of key assortments is visible primarily in projects where we have relatively little material progress.

Gross profitability of the construction segment in the period under review was 3.2%, down from 3.4% in Q1 2021. This year, profitability at the gross profit level was supported by positive financial results from interest earned on deposits.

Unexpected increases in material prices have also translated into our approach to new offers. All projects where calculations were based on prices before the outbreak of war in Ukraine have been recalculated, so that we could make responsible decisions on whether to sign or abandon a tender. In most cases, the updated cost estimates significantly exceeded the values of submitted bids, which forced us to abandon participation in such tenders.

In Q1 2022, we obtained contracts worth over PLN 1.4 billion. Budimex Group's contract portfolio at the end of March 2022 amounted to PLN 13.2 billion and secures the work front for the entire current year and most of 2023. The challenge will be to maintain the contract portfolio over several quarters with a view to securing revenues in future years (beyond 2023).

The Budimex Group ended Q1 2022 with a net cash result of PLN 3 billion. We are planning to pay the remaining dividend for 2021 of PLN 23.47 per share in June 2022. Thus, the total dividend for 2021 per share (including the dividend advance paid in 2021) will be PLN 38.37.

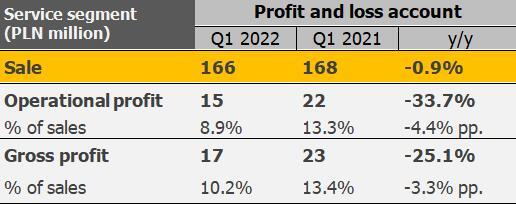

In Q1 2022 the FBSerwis Group maintained a high level of sales revenues while maintaining good profitability. Gross profit amounted to PLN 16 million compared to PLN 22 million in Q1 2021.

Revenues of FBSerwis Group, which is a key asset within the services segment (the results of the services segment also include activities of several smaller companies, including Budimex Parking Wrocław) amounted to PLN 165 million and were similar to the corresponding period of the previous year. The achieved sales volume was slightly higher than our internal plans, which was primarily due to increased throughput in the infrastructure maintenance segment. The increase in prices of key assortments had little impact on FBSerwis Group's core business, namely the environmental services segment. In the segment of infrastructure maintenance, we felt, above all, an increase in fuel prices.

As we anticipated, we are currently fully utilising the potential and production capacity of the FBSerwis Group, which limits the possibility of organic business growth. We focus on investing in expansion of existing waste processing facilities and landfills, which will allow us to increase the scale of our operations using our existing resources. In addition, several acquisition projects are being executed, one of which – acquisition of a company in the waste management sector with annual revenues of around PLN 30 million – could be finalised as early as in the first half of this year. We are looking for companies that will help us carry out our current tasks, fit into the Group's business model and, at the same time, contribute to an increase in sales revenues so as to reach PLN 1 billion in 2026 while maintaining a level of profitability.

We are entering the construction season with a high contract portfolio of PLN 13.2 billion.

As a representative of the industry, we call for revision and updating of escalator clauses, which only partially compensate for an increase in material prices. We welcome the fact that some clients have increased their valorisation limits to 10%, but given the current scale of material price increases and double-digit inflation, this is still not a sufficient level, particularly for contracts in progress.

Lack of valorisation can lead to contractors having to suspend work on contracts or even bankruptcy of companies in a weaker financial position.

Our goal and challenge in the coming year is to maintain our leadership position in key segments of the construction market. At the same time, a difficult situation on the local construction tender market gives us additional arguments for strengthening our presence in neighbouring markets. In the German market, we are executing our first contract and have recently been selected to carry out another tender for construction of a small sports hall. The next stage of our foreign expansion will be winning contracts in the Czech and Slovak markets, where our objective is primarily infrastructure projects. We have made more than a dozen significant bids in these markets in recent months, several of them second best in terms of price.

After purchasing the 7MW Drachowo wind farm project (SPV Magnolia), we immediately started construction work. We are going to start producing green energy as early as next year. We are looking at further investment opportunities in RES, in line with the development directions adopted by the Budimex Group, and our high cash position gives us broad investment opportunities.

We are testing automated OHS monitoring on our construction sites with the winner, Budimex Startup Challenge. We are launching collaboration with the OSA Team of young scientists who are the winners of the European Space Agency's top prize in the CanSat competition.

We have earmarked PLN 0.5 million for specialist hospital medicines for the Children's Neonatal Hospital and St. Panteleimon hospital in Lviv. Together with the Polish Association of Construction Industry Employers, we are co-financing the purchase of an ambulance for Ukraine. In addition, our employees throughout the Ferrovial Group also donate their own funds to humanitarian aid for Ukraine. The money doubled by Ferrovial and Budimex Group will be donated to a jointly selected foundation to help Ukraine. We estimate that the total value of our and our employees’ aid to Ukraine will exceed PLN 4 million.

We are preparing the first two of five Parent Zones this year in the Independent Public Health Care Institution of the District Hospital in Pisz and the Voivodship Children's Hospital of J. Brudziński. We are finishing works on a house for a family of eight in the Dom z Serca 2 project in Pomerania.

In the Infrastructure and Construction Diamonds competition, we won the title of general construction contractor of 2021. Construction of a new power unit in Turów for PGE, carried out by Budimex took first place in the Build Safely competition of the National Labour Inspectorate.

–––––––

BUDIMEX SA is a company with over fifty years of tradition, which has a significant contribution to the economic development of Poland. With our work, we improve the quality of life of millions of Poles. During the 50 years of our existence, we have completed thousands of modern infrastructure, construction and industrial investments. The culture of innovation, improvement and following the principles of sustainable development allowed us to gain the position of a leader in the Polish construction market. Not only are we present on the Polish market, but also abroad. We gradually increase our involvement in the facility management (operation of real estate and infrastructure facilities) and waste management sectors. Since 1995, our company has been listed on the Warsaw Stock Exchange, and since 2011 it has been included in the ESG index – gathering the most responsible companies on the stock exchange. Its strategic investor is a Spanish company with global reach – Ferrovial. The group includes: Mostostal Kraków and FBSerwis.

We are one of the signatories of the Agreement for Safety in Construction – an initiative established in 2010, bringing together the largest general contractors in Poland in order to improve occupational safety in the construction industry.

More information is available at www.budimex.pl/en

Michał Wrzosek Press Spokesman Budimex SA

michal.wrzosek@budimex.pl telephone: (+48) 22 623 61 12 mobile: (+48) 512 47 85 22