Michał Wrzosek Press Spokesman Budimex SA

michal.wrzosek@budimex.pl telephone: (+48) 22 623 61 12 mobile: (+48) 512 47 85 22

Michał Wrzosek Press Spokesman Budimex SA

michal.wrzosek@budimex.pl telephone: (+48) 22 623 61 12 mobile: (+48) 512 47 85 22

We consider the first quarter of 2023 to be very good. Profitability at every level of the achieved result improved, demonstrating the Budimex Group's stable position and providing even better prospects for further responsible growth, due to its increasing involvement in the renewable energy sector.

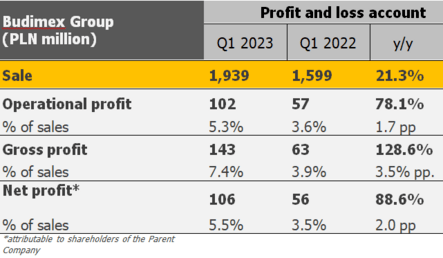

Budimex Group generated an operational profit of PLN 102 million (compared to PLN 57 million in Q1 2022) while recording an increase in profitability from 3.6% to 5.3%. Group revenue increased by 21.3% which, while maintaining cost discipline, improved gross margin profitability.

Gross profit of the Budimex Group amounted to PLN 143 million with profitability of 7.4% compared to 3.9% in the first quarter of the previous year. Profitability at the level of gross profit was supported by significant improvement in financial results, which resulted from higher financial revenues from interest.

We recorded significant growth in the Group's sales revenues, both in the construction segment (+20.1%) and in the services segment (+31.1%).

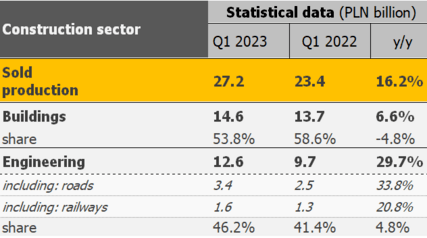

Construction and installation production in Q1 2023 (at current prices) increased year-on-year basis by 16.2% from PLN 23.4 billion to PLN 27.2 billion. In the buildings segment, production sold increased by 6.6%, while in the infrastructure segment the increase was as high as 29.7%.

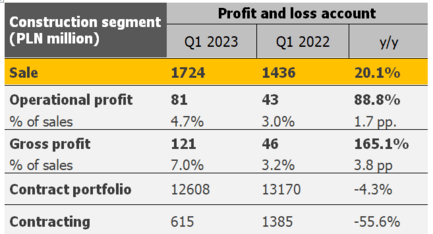

Sales of the Budimex Group's construction segment amounted to PLN 1,724 million in Q1 2023 (+20.1% y/y), while recording am increase in both operating profitability (from 3.0% to 4.7%) and gross profitability (from 3.2% to 7.0%).

The scale of sales revenues in the construction segment, realised in Q1 2023, was noticeably higher than in the corresponding period of the previous year. A high and diverse contract portfolio and favourable weather conditions allowed revenues to increase by more than 20%. Sales were favourably impacted primarily in the area of road contracts; a large portion of contracts that were in the design phase in the first quarter of 2022 moved into the execution phase, reporting higher revenues.

Gross profitability of the construction segment was 4.7%, up from 3.0% in the same period last year. During the period under review, the construction industry was less affected than a year earlier by the disrupted supply chains caused by the outbreak of armed conflict in Ukraine. This resulted in greater price predictability and the availability of major assortments of construction materials, as seen in steel or concrete.

In addition, prices of services offered by major subcontractors in the first quarter of this year fluctuated noticeably less than they did in the same period last year. This is particularly noticeable in the area of construction industry. At the same time, the effects of increases in the prices of construction materials and labour, observed from the time of bidding until the start of construction work (in the case of contracts executed under the design–build formula, this is usually more than a year), were partially absorbed thanks to an increase in the level of valorisation on construction contracts executed for public contracting authorities.

Gross profitability of the construction segment in the period under review was 7.0% and was higher than in Q1 2022, when it amounted to 3.2%. In the first quarter of 2023, in addition to an increase in profitability at the operating level, profitability at the gross profit level was supported by the positive result generated on financing activities from interest earned on deposits.

In Q1 2023, we obtained contracts worth over PLN 600 million. Budimex Group's contract portfolio at the end of March 2023 amounted to PLN 12.6 billion and secures the work front for the entire current year and offers the prospect of maintaining high sales levels for the years 2024-2025. Intense work on the acquisition of new projects has meant that the value of projects awaiting signature, and those where the offer of Budimex or Group companies has been rated highest, is currently at the level of more than PLN 5.3 billion. Looking ahead, this should translate into maintaining the high value of the contract portfolio.

The Budimex Group ended Q1 2023 with a net cash result of approximately PLN 3.3 billion. Fulfilling the adopted dividend policy, the Management Board of Budimex SA recommended to the Supervisory Board and the General Meeting of Shareholders that a dividend should be paid from the profit earned for 2022 in the amount of PLN 459 million, which is PLN 17.99 per share. The dividend would be paid in June 2023.

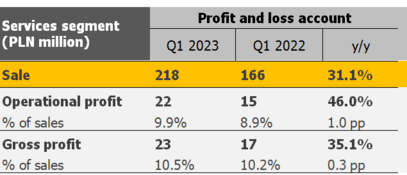

In the first quarter of 2023 the FBSerwis Group reported an increase in sales revenue at the level of PLN 51.4 million while maintaining good profitability. Gross profit amounted to PLN 23 million compared to PLN 16 million in Q1 2022.

Revenues of FBSerwis Group, which is a key asset within the services segment (the results of the services segment also include activities of several smaller companies, including Budimex Parking Wrocław) amounted to PLN 217 million and were 31.1% higher compared to the corresponding period of the previous year. Sales volume growth was achieved in each of the business segments at a higher level than we had anticipated. The increase in sales in the first quarter of 2023 compared to the same period of the previous year is primarily due to the increased scale of operations (the acquisition of shares in a new venture, an increase in waste processing, and a higher number of ongoing contracts in the road segment).

Market perspectives

The Budimex Group's current contract portfolio fully secures the work front and offers the prospect of maintaining a high level of sales in the years 2024-2025.

We view positively the decision of the ordering parties in the infrastructure area to increase the indexes of valorisation of construction contracts. In the face of persistently higher inflation and general economic uncertainty, this allows us to stabilize the profitability of long-term orders and, consequently, has a positive impact on the stability of the entire sector.

The challenges of the coming quarters are primarily new orders for the contract portfolio. On the one hand, our concerns about the tightening of competition in the road market are becoming more and more probable. It is possible that in the perspective of several quarters, the consequence of aggressive pricing policies of competitors will be pressure on margins in the industry. Given the uncertain macroeconomic situation and fluctuations in material prices, we invariably take a cautious approach to new bids, calculating cost estimates fairly and responsibly. We hope that other market participants will also approach bidding in the coming months with integrity and due caution. On the other hand, we are observing continued delays in the financing of rail projects, where we have several important contracts waiting to be signed. This only reinforces our conviction that the chosen directions of development, including segmental diversification by strengthening our position in the hydraulic engineering and military segments, as well as expansion into foreign markets, will allow us to maintain the long-term trend of growth in the contract portfolio and revenues of the construction segment while maintaining stable profitability. We hope that our own projects from the RES field will ensure additional growth.

Continuing on the course of dynamic development in the area of renewable energy investments, in recent weeks we have signed an agreement with our partner Ferrovial to establish a new joint venture, BXF Energia, which is currently working on projects of 110 MW in wind power and 112 MW in photovoltaics at various stages of advancement. In a perspective of 4-5 years, our goal is a portfolio of renewable energy projects with about 500 MW of wind and solar power in operation or under construction.

Awards and distinctions

Supporting the development of the national economy and improving the quality of life of the beneficiaries of the investments made are among the key objectives of Budimex activities. Our commitment is reflected in the awards granted to the company in the first quarter of this year. We received WNP Award for our contribution towards changing the Polish market for the better and the title of Dividend Company of the Year 2022 awarded by Invest Cuffs foundation. Budimex was also named by the Builder magazine as the Construction Company of the Year.

Education

Continuing our efforts to promote jobs in the construction industry,

in early March, we initiated a new instalment of the Budimex Academy student internship program. The “Praktyka jest miarą sukcesu” [Internship is a measure of success] project will benefit 250 students from across the whole Poland. As part of our activities targeting secondary schools, in the first quarter of 2023 we established cooperation with the Technikum Kolejowe [Railway Secondary Technical School] in Warsaw, including joint scientific and technical activities and training ventures.

At the same time we are also implementing a special project with the Zwolnieni z Teorii [Exempt From Theory] Foundation, which had its grand finale on April 21. Over the course of several months, we visited 127 secondary technical schools across Poland. We established cooperation with 40 schools, and 34 teams of students, in cooperation with our experts, took on the challenge of creating original CSR projects. Starting on 1 March, a group of program participants also began internships at Budimex.

ESG activities

As Budimex we want to be a good neighbour who responds to the needs of local communities. As the general contractor of the construction of the tramway to Warsaw's Wilanów district, we are covering the urban space with greenery. At the beginning of the year, we launched the first stage of the “Przystanek Zieleń” [Greenery Stop] project, in which we will plant 400 additional trees by spring 2024 and eventually 1,000, including compensatory plantings, along the tramway line in the Mokotów and Wilanów districts.

As a company with roots in the construction industry, we also attach great importance to safety. At the beginning of this year, the third edition of Budimex proprietary program “Hello ICE” was launched, under the patronage of the Ministry of Sport and Tourism. The aim of the project is to promote appropriate behaviour on the road among children. The first day of educational classes took place in Ziębice.

–––––––

BUDIMEX SA is a company with over fifty years of tradition, which has a significant contribution to the economic development of Poland. With our work, we improve the quality of life of millions of Poles. During the 50 years of our existence, we have completed thousands of modern infrastructure, construction and industrial investments. The culture of innovation, improvement and following the principles of sustainable development allowed us to gain the position of a leader in the Polish construction market. Not only are we present on the Polish market, but also abroad. We gradually increase our involvement in the facility management (operation of real estate and infrastructure facilities) and waste management sectors. Since 1995, our company has been listed on the Warsaw Stock Exchange, and since 2011 it has been included in the ESG index – gathering the most responsible companies on the stock exchange. Its strategic investor is a Spanish company with global reach – Ferrovial. The group includes: Mostostal Kraków and FBSerwis.

We are one of the signatories of the Agreement for Safety in Construction – an initiative established in 2010, bringing together the largest general contractors in Poland in order to improve occupational safety in the construction industry.

More information is available at www.budimex.pl/en

Michał Wrzosek Press Spokesman Budimex SA

michal.wrzosek@budimex.pl telephone: (+48) 22 623 61 12 mobile: (+48) 512 47 85 22